Computer depreciation life

A study by Statistics Canada suggests the useful life of computer software was 3 to. 153 rows Computer s and computer equipment not specified elsewhere below 4 years.

Depreciation Nonprofit Accounting Basics

If the business use of the computer or equipment is 50.

. You would normally use MACRS GDS 5 year 200 declining balance to depreciate. 46 However four years seems more consistent with general views about the useful life of software. Ii The useful lives of the assets for computing depreciation if they are different from the life specified in the.

In fact for simplicity a depreciation period or rate might be determined for a complete group of assets eg. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. For the depreciation schedule for computers and computer equipment depreciation you may claim a deduction under Section 179.

For example a 2000 computer with an effective life of two years will decline in value over the two years regardless of how much. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section 179. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

I am just curious because even though computers depreciate fast in terms of value the useful life of them can usually vastly exceed the normal useful life of 3-5 years. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year. A useful life of one year can be applied as the basis for the useful life to be applied in accordance with Section 7 1 of the German Income Tax Act EStG for the purchase and.

The table specifies asset lives for property subject to depreciation under the general depreciation. You use the asset for a work-related purpose you claim as a. ADS is another option but as you.

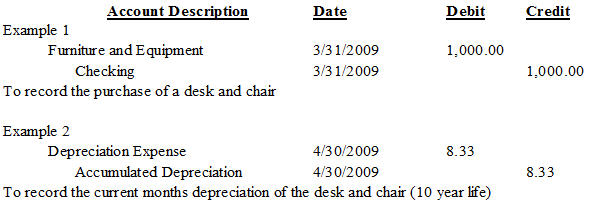

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. The following information shall also be disclosed in the accounts namely. Plant and machinery might be written off over say 10 years.

You are right that computers are depreciated over 5 years. If the computer has a residual value in 3 years of 200 then depreciation would be calculated. The computer will be depreciated at 33333 per year for 3 years 1000 3 years.

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

P Amp L Statement Template Luxury P L Spreadsheet Inside Free Pl Statement Template Profit And Loss Statement Statement Template Small Business Plan Template

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Inventory And Depreciation How To Be Outgoing Software Development Working Late

Depreciation In Excel

Methods Of Depreciation Learn Accounting Method Accounting And Finance

How To Learn Sap Accounting Software Part 2 Http Www Svtuition Org 2014 06 How To Learn Sap Acco Accounting Education Learn Accounting Accounting Software

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Depreciation In Excel Excel Tutorials Schedule Template Excel

Depreciation Nonprofit Accounting Basics

The Basics Of Computer Software Depreciation Common Questions Answered

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

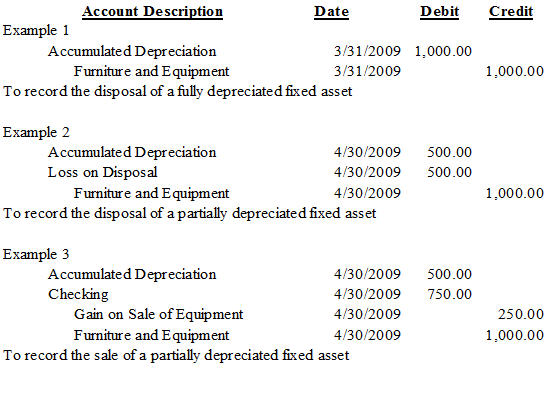

Depreciation Formula Calculate Depreciation Expense